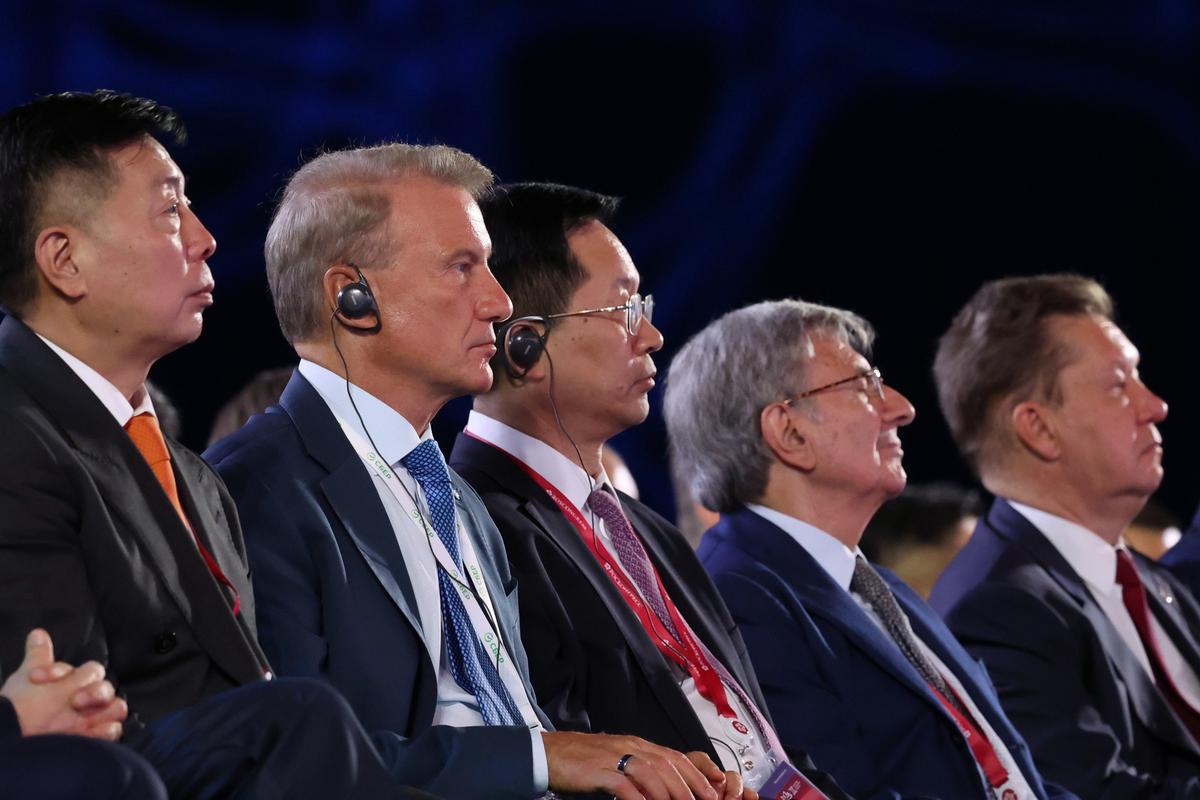

Sberbank CEO German Gref (2nd-L) at the Eastern Economic Forum in Vladivostok, Russia, 5 September 2025. Photo: EPA/ALEXANDER KAZAKOV

The CEO of Russia’s largest bank has warned that the country’s economy is already in a period of “technical stagnation” that could deepen into a recession unless the Central Bank lowers interest rates to stimulate spending, Interfax reported on Thursday.

Speaking at the Eastern Economic Forum in the far eastern city of Vladivostok, German Gref, head of Sberbank, described Russian economic growth in July and August as “approaching zero,” and warned that the Central Bank needed to act quickly in order to avoid “excessive cooling of the economy” and a “protracted investment pause”.

“It is crucial to emerge from the period of controlled economic cooling so that it does not turn into stagnation. It will be much more difficult to restart the economy than cool it down,” Gref said.

Gref’s feeling of unease was mirrored by senior government officials at the Vladivostok forum on Thursday, with Economic Development Minister Maxim Reshetnikov telling journalists on the sidelines of the conference that the economy was “cooling faster than expected,” according to Interfax.

Though during a televised Kremlin meeting at the end of August, Russian Finance Minister Anton Siluanov told Vladimir Putin that “economic growth would be no less than 1.5%” in 2025. TASS reported earlier this week that the Russian government had revised its GDP growth prediction for 2025 to 1.2%, down from its April forecast of 2.5%.

Speaking at the Eastern Economic Forum on Friday, Putin rejected Gref’s interpretation that the Russian economy had entered technical stagnation, and maintained that the most important thing for the Russian economy was to combat inflation, according to state-affiliated business daily Kommersant.

“Some people think that a kind of hypothermia has already set in, but lending has not stopped. Ask Gref, has lending stopped? No. The rate of growth has [only] decreased,” Putin said.

In October 2024, Russia’s Central Bank raised its key interest rate to 21% — the highest rate in two decades — in order to tackle the snowballing rate of inflation being fueled by the country’s vast military expenditure. Despite recently lowering its key rate to 18% in late July, the Russian Central Bank has resisted making more drastic cuts due to the state’s continuing high levels of spending.